Innovative Financing

One element of APAH’s success in developing affordable housing is our innovative approach to financing, which includes close collaboration with local and national resources.

For example, APAH pioneered the hybrid use of low-income tax credits in Virginia, an innovative way of combining both 4% and 9% credits in the same development. Because of the success of APAH’s innovation, Virginia Housing revised its tax credit allocation plan to provide incentives to developers for using this financing model, resulting in hundreds of new affordable units across the Commonwealth. APAH has been successful in every tax credit application, despite a competitive market.

While projects using the 4%/9% hybrid model are separate structures according to the IRS, residents enjoy a smooth and seamless experience renting anywhere in the buildings. Since 2016, APAH has created five hybrid developments: Queens Court, Columbia Hills, Gilliam Place, Terwilliger Place, and Loudoun View. A sixth project is slated to begin construction in September 2021. Five more hybrid projects are currently in the planning stage.

Our real estate development team is also known for its tenacity, as we will continue to pursue creative financing options even when projects come to us that have not been successful in the past.

Affordable Housing Investment Fund

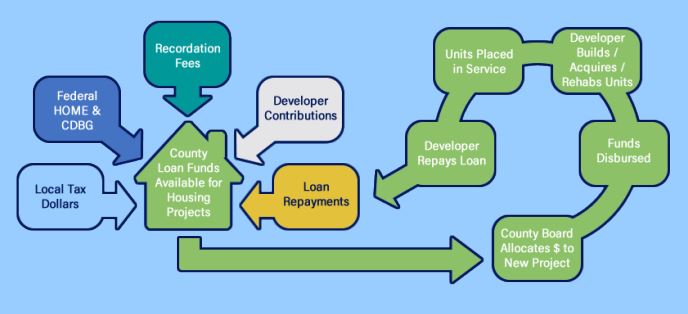

Since its creation in 1988, the Affordable Housing Investment Fund has been Arlington County’s main financing program for the development of affordable housing. The program has enabled the majority of the approximately 8,300 rental units approved throughout the County that help provide homes for low- and moderate-income households, including specialized housing for the elderly, the homeless, or persons with disabilities.

The Fund supports affordable housing development and preservation in Arlington by:

- Providing low-interest, subordinate loans for developers of affordable housing.

- Subsidizing renovations and upgrades to keep existing affordable housing safe and sustainable.

- Alleviating the dramatic loss of affordable housing units in multifamily properties.

How Does AHIF Work?

AHIF operates as a revolving loan fund, ensuring the loans are repaid in a timely manner and enabling the County to leverage its investments to build more affordable housing.

AHIF in Our Community

AHIF is an important funding source for the development of affordable housing within our County, often helping to fill a “gap” in financing. Every year, the County determines an AHIF allocation in its annual budgeting process. In Fiscal Year 2017, the County allocated a total of $15 million, which is comprised of local and federal dollars and is also supported by loan repayments and developer contributions.

AHIF and APAH

APAH is proud to have received AHIF funding in many of our affordable housing developments. Here are a few of the most recent projects that received AHIF funding:

Learn More

- Arlington County: “Affordable Housing Investment Fund“

- Arlington County: “Affordable Housing Master Plan“

- Arlington County: “Affordable Housing Master Plan Fiscal Year 2017 Annual Report“

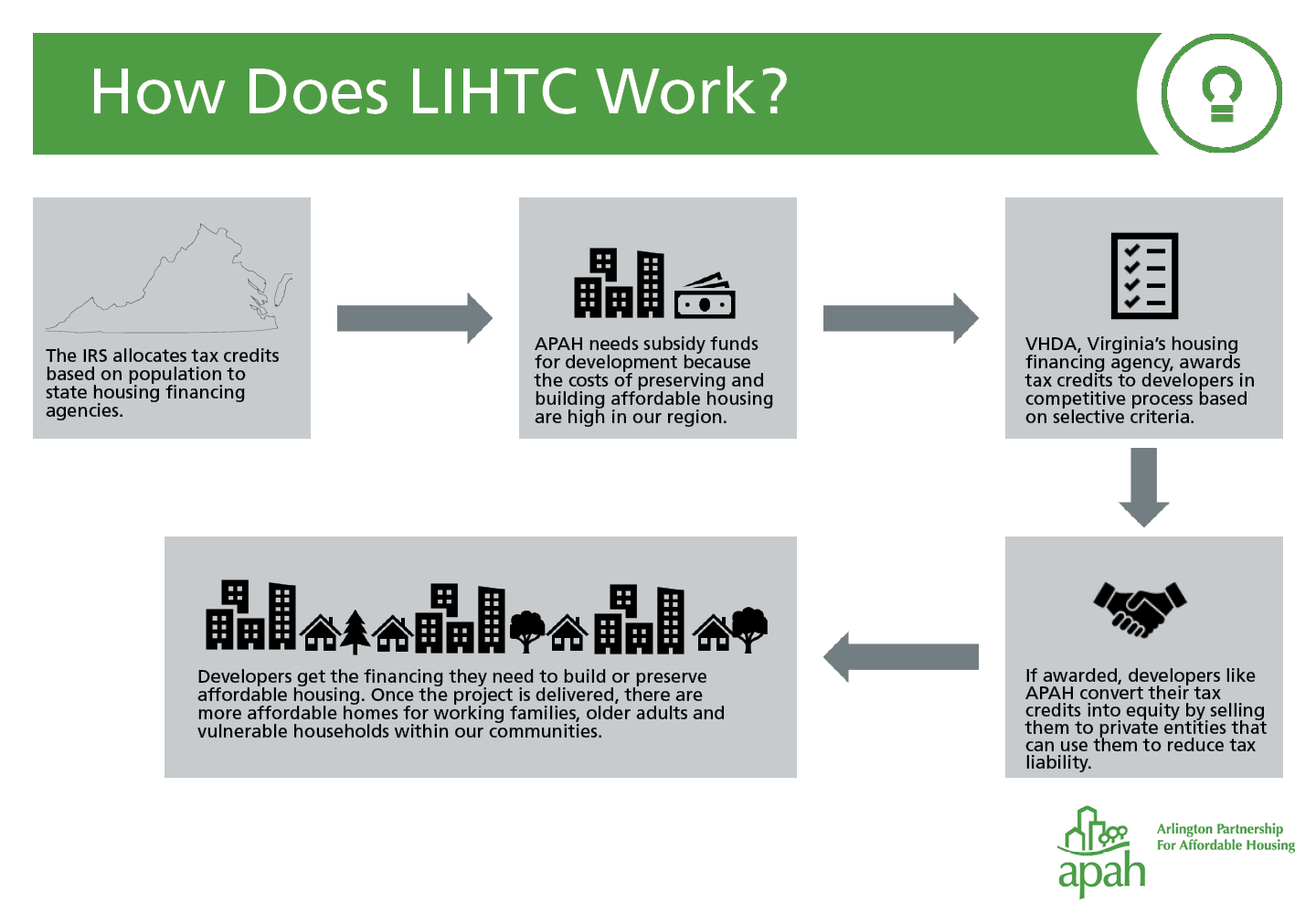

Low-Income Tax Credits

The Low Income Housing Tax Credit program, (LIHTC), is the largest and most successful tool in the nation to preserve and build affordable housing. Since its inception in 1986, LIHTC has financed 3 million affordable apartments and provided homes to approximately 7 million low income households.1

In addition to creating more much-needed affordable housing, the National Association of Home Builders estimates that LIHTC has generated $323 billion in local income and 3.4 million jobs over the last 30 years. Thus, the development of affordable housing is a critical component of our nation’s economic growth.

As our region faces a vast and growing affordability crisis, LIHTC is one of our most powerful tools we can use to address it and ensure that our communities remain diverse and inclusive for all.

LIHTC in Our Community

The Virginia Housing Development Authority (VHDA) administers the state of Virginia’s annual tax credit pool. Every year, VHDA manages a competitive process where developers like APAH can apply for a portion of the state tax credits. VHDA then allocates the credits to the affordable housing developments that are most responsive to housing needs. In 2017, APAH applied for and won tax credit equity to finance the development of Gilliam Place. APAH has won credits every year we have applied.

Learn More

- Enterprise Community Partners: “The Low-Income Housing Tax Credit“

- Novogradac & Company: “About the LIHTC“